Spring Into Adventure: Our Top Picks for Active Excursions

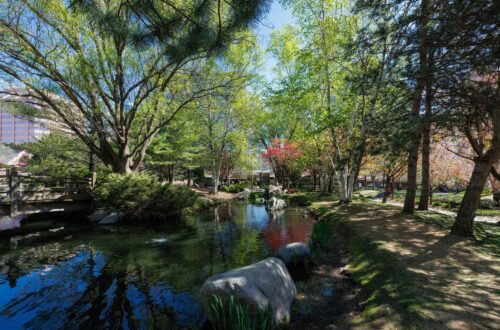

From scenic walks and biking trails to climbing adventures, we’ve compiled some of our favourite ways to get active in Mississauga this Spring.

Friendly and full of surprises. Mississauga is yours to explore. From biking to hiking, shopping to sightseeing, Mississauga has something for everyone. Whether you come for the day, or plan an overnight stay – we hope to see you soon!

Check out what’s happening across the City. Everything you need to kick off your Mississauga adventure – take in the festivities & join in the fun!

Earn rewards while you explore Mississauga's culinary hidden gems with this pass curated by Suresh Doss.

The latest news, articles & itinerary ideas on things to see & do across the city this season!

From scenic walks and biking trails to climbing adventures, we’ve compiled some of our favourite ways to get active in Mississauga this Spring.

Plan the perfect Spring excursion to see the cherry blossoms with our itinerary showcasing more to see nearby, can’t-miss events happening during peak season and tips for the best viewing experience.

Spring has sprung and rain or shine, there’s lots to do in Mississauga this April. Experience a world of art, culture and entertainment at these exciting exhibitions and events.