City Provides Additional Financial Assistance for Taxpayers during COVID-19

COVID-19 | May 6, 2020

Today, Council unanimously agreed to provide further financial assistance to taxpayers to help ease financial pressures as a result of the impacts of COVID-19 by:

- deferring final tax instalments for 90 days

- stopping late payment charges and fees related to tax payment requests for changes

Council previously provided cash flow assistance by deferring the April to June interim tax instalment dates by 90 days and is again asking all landlords to pass this additional financial relief on their tenants.

“We are doing what we can as a City to provide as much relief to residents and businesses as possible,” said Mayor Bonnie Crombie. “Today’s decision to defer property tax instalments and waive penalty fees will help taxpayers recovering from the shock of this crisis manage their cash flow in a difficult time. As a City, we do not have the financial resources of the federal and provincial governments to offer full relief, but we are doing what we can within our power while remaining financial prudence.”

The City of Mississauga is looking at all options available for recovering and balancing its 2020 operating and capital costs as a result of the impacts from COVID-19 and as required by-law.

“With the support and approval of Council, we are working to try and ease some of the economic impacts and financial hardships being faced by many families and businesses in Mississauga as a result of the COVID-19 pandemic,” said Janice Baker, City Manager and Chief Administrative Officer. “At the same time, we are carefully monitoring the City’s operating and capital budgets and identifying opportunities for cost avoidance, including potentially deferring some of our capital spending this year. We are thankful to both the Region of Peel and the Government of Ontario for deferring the upper-tier and education tax payments which is greatly assisting the City during this challenging time. We are however, still facing significant revenue shortfalls. We need and are seeking, financial assistance from both the provincial and federal governments.”

Interim Tax Payment Schedules

As decided at the March 20 meeting of Council, interim property tax payments were deferred for 90 days. Notices were distributed to taxpayers at the end of March.

1. Regular Instalment Payments

For those paying by regular instalment, interim property tax payments of April 2 and May 7 were deferred to July 2 and August 6.

| New Interim Payment Schedule Due Dates | |

|---|---|

| July 2, 2020 | August 6, 2020 |

2. Monthly Pre-Authorized Payments

For those paying by monthly pre-authorized payments with the City, interim property tax payments in April, May and June were deferred to July, August and September.

| Residential and Non-Residential | |||

|---|---|---|---|

| New Interim Payment Schedule Due Dates | July 2020 | August 2020 | September 2020 |

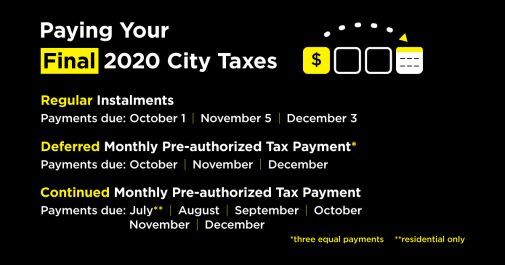

Final Tax Payment Schedules

The timing of final tax payments for residential and non-residential property owners will depend on their chosen method of payment and if they continued with their interim tax payments as originally billed.

3. Regular Instalment Payments

Final tax payments have been deferred by 90 days for taxpayers currently paying by instalments. Payments will now be made in October, November and December.

| Residential and Non-Residential | |||

|---|---|---|---|

| New Final Payment Schedule Due Dates – final tax instalments | October 1, 2020 | November 5, 2020 | December 3, 2020 |

For residential properties, final tax instalments would normally be due in July, August and September. For non-residential properties, final tax instalments normally would be due as one single payment in August.

4. Monthly Pre-Authorized Payments – Interim Payments were Deferred

For taxpayers who had monthly withdrawals deferred, final payments will be made in three equal withdrawals one in October, one in November and one in December.

| Residential and Non-Residential | |||

|---|---|---|---|

| New Final Payment Schedule Due Dates – if Interim tax payments were deferred | October 2020 Withdrawal payment |

November 2020 Withdrawal payment |

December 2020 Withdrawal payment |

5. Monthly Pre-Authorized Payments – Payments Continued

Taxpayers who have chosen to continue to make regular monthly payments for their interim taxes will continue with monthly withdrawals on their normal schedule.

| Residential and Non-Residential | ||||||

|---|---|---|---|---|---|---|

| Payment Schedule Unchanged Interim tax payments continued |

July 2020 *residential only Monthly withdrawal |

August 2020 Monthly withdrawal |

September 2020 Monthly withdrawal |

October 2020 Monthly withdrawal |

November 2020 Monthly withdrawal |

December 2020 Monthly withdrawal |

Property assessment is determined by the Municipal Property Assessment Corporation (MPAC). These assessments are updated every four years and increases are phased-in over a four-year period. The last re-assessment was conducted in 2016. The next MPAC reassessment was planned to be completed this year for the 2021 taxation year; however, due to the COVID-19 pandemic, the Government of Ontario postponed the assessment update. This means the property assessment used for the 2021 tax year will be the same as the 2020 tax year.

In addition, to the COVID-19 assistance, the City of Mississauga is also continuing with its annual tax rebate for low-income seniors and low-income persons with disabilities. For 2020, the annual rebate has been increased to $436.

Read the full report: 2020 Final Levy Taxation Addressing COVID-19 Impacts

To learn more about the City of Mississauga’s taxes and assessment processes.

Tags

Media Contact:

City of Mississauga Media Relations

media@mississauga.ca

905-615-3200, ext. 5232

TTY: 905-896-5151