Clarifying property taxes: Understanding the City’s budget

Work is well underway to develop the City of Mississauga’s proposed 2026 Budget. We want to ensure residents have a clear understanding about their property taxes, and the programs and services they fund, before the City budget is released in early January 2026.

City services | August 12, 2025

“I don’t want to pay more”, “Why are my taxes so high?”, “Where does all the money go?”. These are frequent comments and questions that come up when Mississauga residents hear about taxes or the City’s budget. It’s understandable – no one wants to pay more for existing or new services and programs.

Like you, the City is feeling the impact of rising costs for goods and services such as contractor costs, fuel, heat, electricity, supplies, and much more. In addition, there are a lot of new and unique challenges to contend with like more severe weather events and new responsibilities placed on the City by the federal and provincial governments.

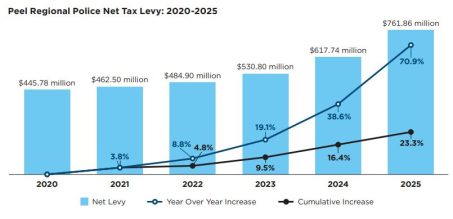

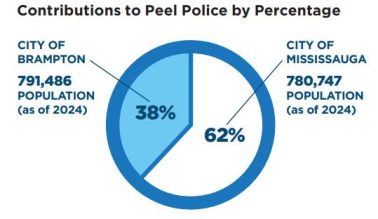

There are many factors that impact property taxes — the property assessments by the Municipal Property Assessment Corporation; the cost of providing City, Regional and Provincial (education) services, including Peel Regional Police whose budget grew by 23.3 per cent in 2025 – which is 4.6 per cent on your property tax bill; program expansions to serve a growing population; and more. A quick summary is available in this helpful property tax video.

Mississauga taxpayers overburdened by the rising cost of public safety

In 2025, 4.6 per cent of the City’s property tax bill is directly tied to a historic 23.3 per cent increase in the Peel Police budget. This spike alone will cost a Mississauga homeowner more than $520 this year for a home with an assessment value of $1.2 million and with another similar increase already projected for 2026. These decisions are made at the Regional level, where Mississauga has limited control, despite significantly funding our Regional policing costs.

For more details read the Mayor’s residential tax newsletter.

Things aren’t the same anymore

Some longtime residents of Mississauga say they have “never seen such high taxes before”. Over the past few decades, Mississauga has grown rapidly, evolving from a bedroom community into a sprawling urban city. A transformed downtown, key investments in the waterfront areas, major transportation enhancements, and parks and community centres in every corner of the city are all major milestones in Mississauga’s growth journey. Timely investments are required to keep pace with population growth and foster a vibrant economy.

Simply put, the budget is more than dollars and cents. It’s important to stay informed and learn about how the budget is developed and how your tax dollars are used. Before the 2026 Budget season, let’s clear the air and break down how the budget works and why property tax increases are necessary.

While property taxes are not everyone’s favourite topic, they are the driving force that make many services and amenities possible in our community, such as your favourite park, library books, kids’ free bus rides and snow-cleared roads.

The City is committed to developing a budget that prioritizes taxpayers, delivers high-quality City services and supports Mississauga’s growth. This is no easy task. It means we will address your needs while investing in long-term projects, always keeping you and your families in mind.

Property taxes are the City’s bread and butter

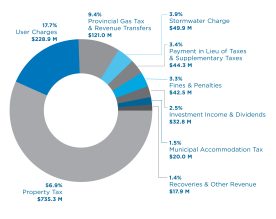

Provincial legislation outlines what types of revenue a municipality can collect. Property taxes are the primary source of revenue for the City. They represent around 57 per cent of all money received by the City to deliver many services and programs that the community relies on. Other sources include government grants, user fees such as MiWay fares, registration fees for recreation programs, business licence fees, and other fees and charges like facility room rentals.

The City doesn’t get to keep all the property taxes collected.

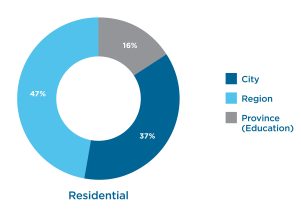

Only 37 per cent of every property tax dollar collected is used to provide more than 200 City services to residents, such as fire and emergency response, programs at community centres and libraries, vibrant events and more. The majority – 47 per cent – goes to the Region of Peel for services they provide such as police, paramedics, health services, social housing, and other supports. The remaining 16 per cent goes to the Government of Ontario to fund school education, even though it is a provincial responsibility.

The City also has a duty to maintain its $18.7 billion in infrastructure such as roads, parks, and stormwater pipes in good condition to ensure safe communities. Infrastructure is one of the most expensive costs for the City. Significant investments are required on a continuous basis. Additionally, the City must also save for the future and unexpected events like storms and floods, which can lead to costly repairs.

In Canada, cities like Mississauga own 66 per cent of all the infrastructure, but they only receive 10 cents of every tax dollar collected. The rest goes to the federal and provincial governments. Cities can only raise money through property taxes, limited fees and charges, or by issuing debt, unlike the federal and provincial governments which collect income and payroll taxes, sales taxes, and additional revenue. When the economy does well, the federal and provincial governments do well. That’s not the case for cities. How government money is divided is as important as how it is collected.

Getting to know budget service areas

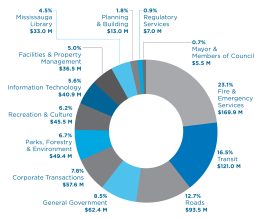

The City’s budget is structured to deliver more than 200 programs in 13 key service areas. This includes maintaining existing services, implementing new initiatives, and ensuring infrastructure is well-maintained.

How property taxes affect life in Mississauga

We often hear “what am I getting for my taxes?”. City budgeting is about choices. Throughout the year, City staff gather information about community needs. This includes input received through master plans, project-specific public consultation, resident satisfaction surveys, Council meetings, advisory committees and resident deputations, and from frontline staff. For instance, the community had expressed a desire for citywide windrow clearing (clearing the snow left behind on the base of driveways after the snow plow clears the streets), as well as free transit for seniors and children aged 12 and under, all of which led to an increase in the 2025 Budget. These choices are examples of widely requested services that demonstrate how resident feedback can shape the budget, resulting in meaningful changes that help improve life in the city.

Weathering all pressures

Mississauga’s budget serves more than 780,000 residents and helps plan for both now and the future. But as a large and growing urban city, expanding our transit and fire fleets, community centres and public spaces also drives up the cost of operating and maintaining these services. Add to that, inflation, impacts of climate change, a historically high police services budget and more – that’s a growing list of pressures.

Saving you money

Before the annual budget is presented, the City digs deep to explore cost savings and smarter, less expensive ways of delivering services. Adopting new technology to speed up a licence or permit process, and changing to more environmentally friendly buses, equipment and amenities are some of the ways that the City explores cost savings and efficiencies.

Since 2014, the City’s service areas have identified cost savings of $56.2 million without negative impacts to existing service levels. The 2025 Budget included cost savings of $1.3 million. We continue to focus on finding the best, most cost-effective way to deliver services, to save you money.

Get budget-savvy

It may be a few months before you have the opportunity to provide feedback on the City’s proposed 2026 Budget. In the meantime, give yourself a budget refresher through these useful resources available on the budget webpage mississauga.ca/budget.

- How the City budget works

- How the City gets money

- How the City spends money

- What caused the high increase in your 2025 taxes

- What infrastructure is important for the City to maintain

Review the 2025 Budget document for context, and to see how the City is investing in new initiatives, programs and services that matter to you.

Browse through the agenda of March 26, 2025, Budget Committee meeting or watch the video.

Stay tuned for the next Budget Committee meeting coming up on October 1, 2025, about user fees and charges.

Have ideas about the budget and want to share them with the City? Reach out to your Councillor or email budget@mississauga.ca to highlight what you see as priorities.

Together, we’re building a stronger and vibrant Mississauga with accessible and affordable programs and services for all residents.

Tags

Media contact

City of Mississauga Media Relations

media@mississauga.ca

905-615-3200, ext. 5232

TTY: 905-896-5151

Get email updates