More than just dollars and cents: understanding Mississauga’s upcoming budget process as new cycle begins

The budget allows the City to pay for necessary programs, services, and infrastructure such as emergency services, road maintenance, and public transit.

City services | September 16, 2024

Whether it’s spending time at a local community centre, participating in a workshop at the library, taking the bus to work, or having your snow plowed from City streets — each of these services demonstrates the City’s budget at work.

The City’s budget isn’t just a document with numbers — it’s a commitment to building a vibrant city that is welcoming, accepting and makes everyone feel at home.

The budget allows the City to invest in areas like emergency services, road maintenance, and public transit, truly matter to residents and their families, making life easier, safer, and more convenient. Prioritizing infrastructure, building and growth while maintaining a safe and healthy community. The budget outlines how the City allocates resources and funds to meet service expectations for more than 200 programs and services across 13 service areas, while ensuring affordability for residents and businesses.

As we continue to evolve as a big urban city, so do our priorities. The City aims to ensure that tax dollars are used in the best interest of our community, in areas that truly matter to residents and their families, to make life easier, safer, and more convenient.

Property tax

Property tax is the primary source of revenue for funding services in Mississauga. They fund services such as MiWay, climate change mitigation, infrastructure like sidewalks and road repair, fire and emergency services, parks and trails, classes and workshops at community centres and libraries, events, and support for small businesses and major construction.

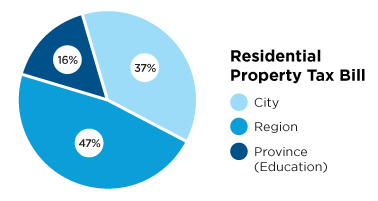

For every property tax dollar collected, roughly one-third stays with the City of Mississauga. The rest is allocated to the Region of Peel and the Government of Ontario’s Ministry of Education.

While tax increases can be challenging, they are also necessary to maintain the high-quality services and programs that residents have come to rely on. These increases also help to ensure that the City’s $18.5 billion worth of infrastructure remains in a state of good repair. Like other municipalities around the Province, the City is grappling with rising inflation rates, and supply chain disruptions. All these factors contribute to the City’s budget and overall tax rate.

Other revenue sources

In addition to residential and commercial property taxes, we collect revenue from the following sources:

- User fees

- Canada Community-Building Fund

- Provincial gas tax and revenue transfers

- Fines and penalties

- Payments in lieu of taxes and supplementary taxes

- Investment income and dividends

- Municipal Accommodation Tax

- Recoveries and other revenue

As a city, we continuously explore other ways to generate revenue to offset operating costs. As Mississauga does not have permission from the Government of Ontario to create new revenue sources, such as the Land Transfer Tax, we’re striving to balance our budget by managing expenses and seeking efficiencies. Since 2013, the Lean methodology has helped City of Mississauga keep up with the increased demand for programs and services by making minor improvements and adjustments while eliminating redundancies and using fewer resources.

Balancing the Budget

The Municipal Act, 2001 requires all municipalities to prepare balanced budgets every year. This requirement means that the money spent must be equal to the money raised. To balance the budget, the City can either increase its revenue using tools such as property taxes and fees or manage expenses by changing or reducing the services offered or projects planned.

Budget process

Under the Strong Mayor Powers statute in Ontario, the Mayor has the authority to propose the budget and veto Council resolutions. Once the Mayor proposes the budget, it is posted on mississauga.ca. After the budget is proposed, Council has 30 days to pass any resolutions proposing amendments. If there are no amendments, the budget is adopted. If there are any proposed amendments, within the subsequent 10 days, the Mayor can decide to veto Council’s resolutions. If the Mayor doesn’t veto, the budget is adopted. Learn more about the budget process.

Budget Committee

The City’s Budget Committee is a standing committee made up of the Mayor and all members of Council to discuss, decide and recommend the City budget.

The Budget Committee is committed to transparency and accountability and is also responsible for:

- Hearing deputations and questions from the public.

- Hearing and receiving staff reports and recommendations regarding the City’s operating and capital budgets.

- Providing advice and recommendations to the Mayor regarding the City’s operating and capital budgets.

- Making recommendations to Council on any operating or capital budget items in which the Mayor has a fiscal interest.

New Budget Committee structure

Earlier this year, Mayor Parrish established a new Budget Committee structure to include two new roles, a Chair and Vice-Chair. Throughout the year, each councillor will meet with residents to establish budget priorities. This committee, led by Ward 11 Councillor Brad Butt as Chair and Ward 1 Councillor Stephen Dasko as Vice-Chair, will meet at least four times a year to discuss the City’s budget.

Budget Committee meeting

The Budget Committee is a standing committee of the City of Mississauga Council responsible for reviewing, recommending, and ultimately approving the city’s operating and capital budgets.

The full schedule of meetings is available online at Council and Committees Calendar Listings. If you miss a live meeting, you can always watch it at a later time as all Budget Committee meetings are recorded and made live for the public.

The Budget Book

The City’s budget book provides an overview of the budget process, including total revenue, expenses, and property tax changes, and how it supports the City’s Strategic Plan. It breaks down business plans and budgets, the business plan and budget for each of the City’s 13 service areas, and one for Corporate Transactions includes financial policies, and offers detailed reports on reserves and funds. There’s also a glossary to explain terms, and any updates made after the budget is approved will be added.

Get involved and stay informed

Community engagement is a core value at the City of Mississauga and continues to be a priority. By participating in the budgeting process, residents help shape where and how City resources and funding are allocated to meet community needs and aspirations.

By participating and staying informed and engaged in the City’s Budget, you’ll better understand how your tax dollars are being spent.

- Watching the Budget Basics video.

- Attending a Budget Committee meeting or watch and listen to the live stream video.

- Calling 311 or email a question or comment about the budget to budget@mississauga.ca.

- Reviewing the City’s Budget website to learn how the City budget works, including how the City gets money and how the City spends money.

- Following budget conversations and posts on the City’s Facebook, LinkedIn and X channels. Search for #SaugaBudget.

Tags

Media contact

City of Mississauga Media Relations

media@mississauga.ca

905-615-3200, ext. 5232

TTY: 905-896-5151

Get email updates